Newsquawk Analysis: Sell-side on CoreWeave (CRWV) post-earnings; PT cuts aplenty amid revenue forecast cut

Analysis details (13:00)

Shares are tumbling c. 9.5% pre-market, as despite results topping Wall St. expectations it cut FY25 revenue view to USD 5.05-5.15bln (prev. 5.15-5.35bln, exp. 5.29bln) and said it faced delays with a key data centre partner. Co. added that the impacted customer had agreed to extend the contract, keeping the deal's total value intact. Weakness in CRWV is also weighing on peers.

Post-earnings commentary:

JPM lowered PT to USD 110 (prev. 135) and downgraded shares to Neutral from Overweight; said mounting supply chain pressures offset "very robust" bookings performance.

- Continues to see tremendous long-term opportunity for CoreWeave to serve the AI mega-trend, but more tactically, in JPM’s view, Q3 results include both positive and negative developments.

- Firm's view of CRWV’s longer term opportunity remains unchanged, but it now has difficulty in forecasting CoreWeave going forward.

- JPM remains “contemplative of the unprecedented and mounting industry-wide pressures across supply chains, and resultant difficulty of confidently forecasting how and when all of the interconnected variables will smoothly reach a point of equilibrium.”

- As a result, while JPM remains constructive on CoreWeave fundamentally, it is shifting to a Neutral rating.

Mizuho lowered PT to USD 120 (prev. 150) and keeps a Neutral rating on shares

- Size of the sales beat was more moderate than Cos. last two quarters, and Q4 guidance was lowered due to infrastructure timing issues for one data centre.

- Mizuho is now "incrementally less optimistic" about CRWV’s rev. upside potential over the near term.

Jefferies lowered PT to USD 155 (prev. 180) and keeps a Buy rating on shares.

- Lost rev. and income should come back in H1 ‘26. Jefferies add shares trade at an attractive risk/reward considering the upside potential to numbers but cites capacity constraints for the PT cut.

Evercore ISI lowered PT to USD 160 (prev. 175) and keeps an Outperform rating on shares.

- While Q3 metrics topped, mgmt. indicated that temporarily delayed deliveries of third-party provided data centre powered shell will impact Q4 rev., resulting in an implied Q4 rev. view of USD 1.54bln (exp. 1.8bln).

- Evercore notes while the current guide down is disappointing, thinks CoreWeave remains well positioned to sustain revenue and EBITDA upside in 2026.

BofA lowered PT to USD 140 (prev. 168) and keeps a Neutral rating on shares.

- While noting Co. lowered FY25 outlook by USD 150mln to USD 5.10bln, BofA said the delta was driven by a supply constraint that it views as fixable by Q1.

Melius Research lowered PT to USD 140 (prev. 165) and keeps a Buy rating on shares.

- Remarked CRWV made good progress in rev. backlog, but near-term blip could cause some concern around the pace at which rev. (and GPU/networking capex) can recover in and after Q1 ’26.

Morgan Stanley raised PT to USD 99 (prev. 91) and keeps an Equal Weight rating on shares.

- Strong demand for GPU capacity against limited supply create the opportunity that enables CoreWeave's "unprecedented pace of scaling as the market's most effective GPU cluster builder". MS adds, however, a lack of delivery due to supply constraints, while short-term, highlights execution risk.

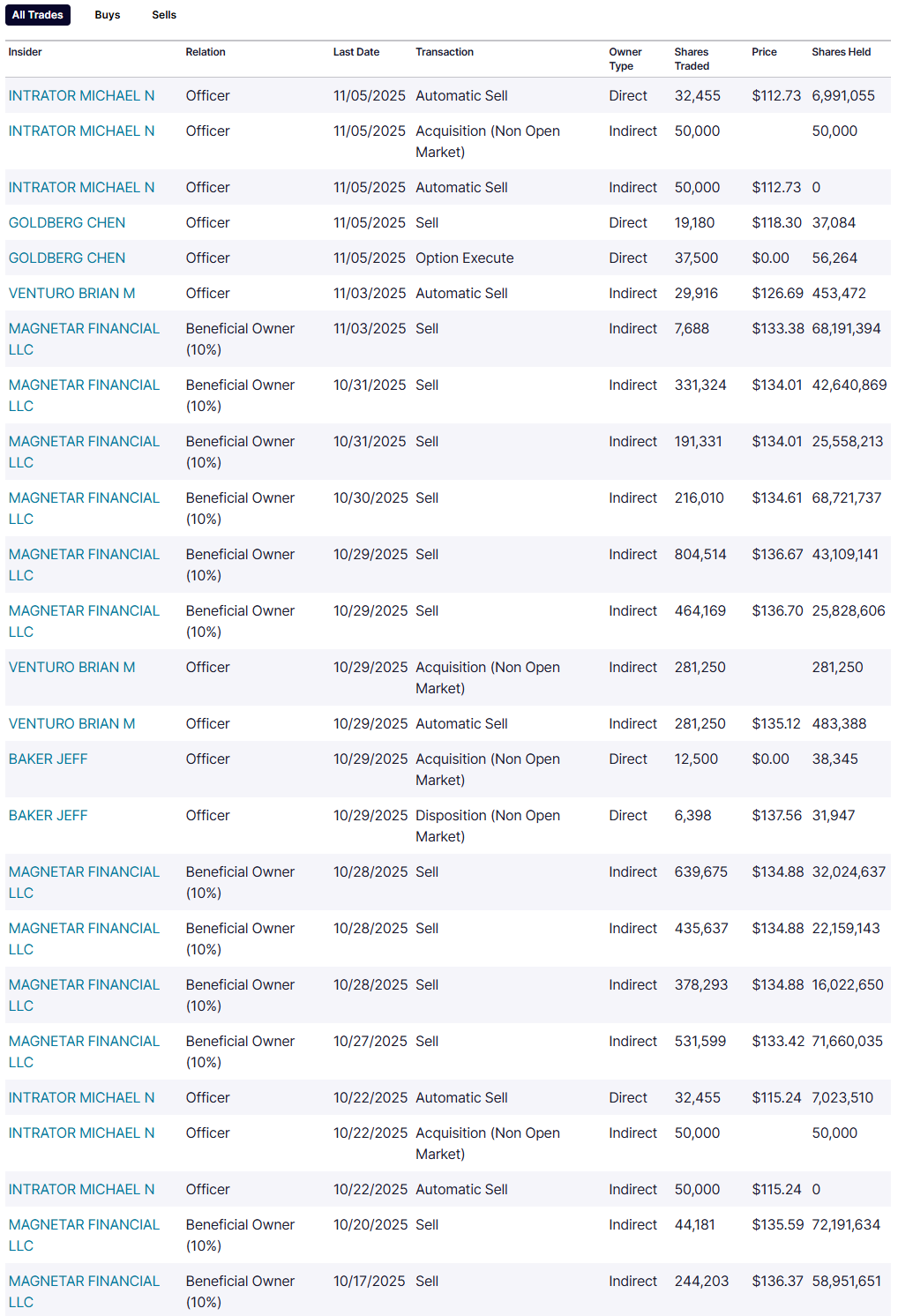

Recent Insider Transactions via Nasdaq:

11 Nov 2025 - 13:00- ForexResearch Sheet- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts