NEWSQUAWK ANALYSIS: Recent crude upside and rally in time spreads after US sanctions Russia Energy

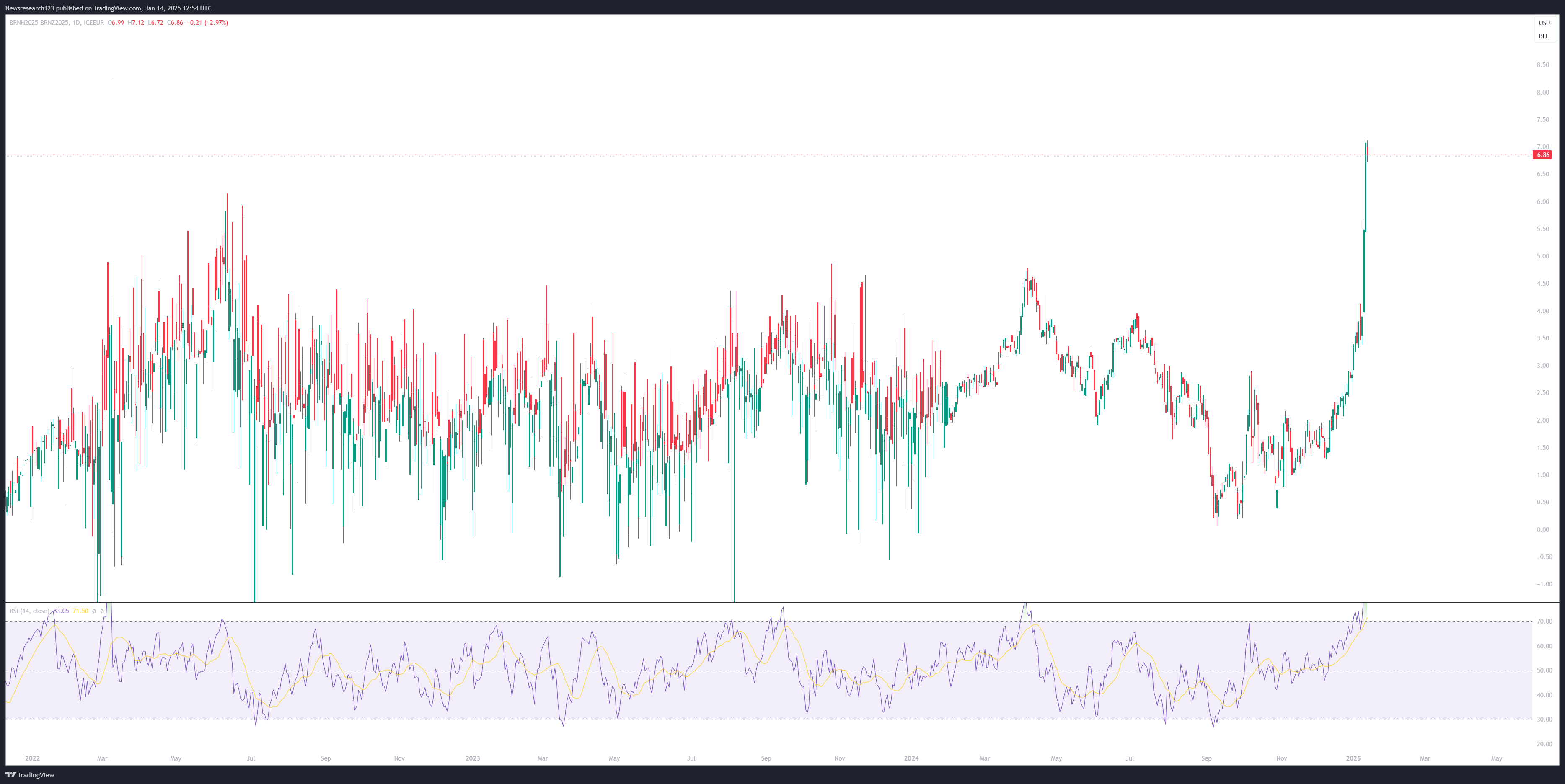

Crude prices have rallied in recent sessions supported by a number of reasons, including the hot US jobs report, China jawboning, as well as fresh US sanctions on Russia. On Friday, the US announced fresh sanctions on Russia that targeted energy producers, shippers, insurers, tankers and traders, which included 183 vessels that shipped Russian oil. The sanctions also targeted Russia's Gazpromneft and Surgutneftegas, which UBS highlights combined produce c. 2mln BPD and export 900k BPD. The desk also points out the 183 tankers, which transported around 1.5mln BPD of crude oil and 200k BPD of refined products in 2024. This has seen Brent (H25) crude reclaim USD 80/bbl to a peak of USD 81.68/bbl with WTI (G25) peaking at USD 79.25/bbl. There has also been a noticeable widening in time spreads with the futures curve showing a steeper backwardation. The crude time spreads (H25-Z25) have soared to levels not seen since March 2022, with the Brent H25 future trading at a c. USD 7 premium to Z25 (see below).

On Monday, a weekend after the sanctions were announced, Reuters highlighted that at least 65 tankers have anchored in Asia, Russia, Middle East after US sanctions announced on January 10th. The report noted that five of the tankers were stationary off Chinese ports, seven were off Singapore, and others were halted near Russia in the Baltic Sea and Far East. The halted tankers included 25 tankers that were stationary around other various locations, including Iranian ports and also near the Suez Canal. Meanwhile, the report noted that some ports had already acted before the latest measures, with the Shandong Port Group banning tankers under US sanctions from calling at its ports, while reports also note that Indian refiners have stopped dealing with tankers on the list. UBS highlights the crackdown of these Chinese and Indian ports, will likely see Indian and Chinese refineries source more oil from the Middle East, Africa and the Americas in the near term, tightening the oil market - as seen in the backwardation of the futures curve.

Looking ahead, Goldman Sachs highlighted that the sanctions announcement supports their view that the risks to their USD 70-85/bbl Brent range forecast are skewed to the upside. Goldman suggests Brent could go above the top end of their forecast if Russian production briefly falls by 1mln BPD and to USD 90/bbl in a combined scenario where Iran supply also falls 1mln BPD, but in a persistent way. Goldman also note that "Across scenarios, the long-term price impact of lower sanctioned supply is limited because we assume that OPEC+ would stabilize the market by deploying its high spare capacity and by raising production for longer than in our base case".

With President-elect Trump's Inauguration next week, his trade policy will be closely watched by market participants after taking an aggressive stance in his run up to the election to see if this stance is maintained. For oil specifically, he has taken a "drill, baby, drill" approach to US producers but there are concerns he will target the availability of Iranian barrels with the incoming Ukraine Envoy Kellogg stating the world must return to a policy of "maximum pressure" against Iran.

Brent Time Spreads (H25-Z25)

14 Jan 2025 - 13:02- EnergyGeopolitical- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts